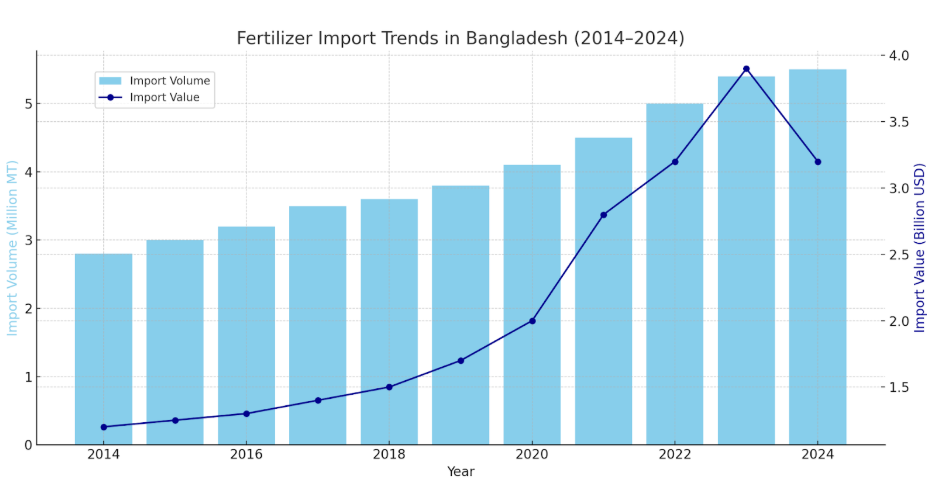

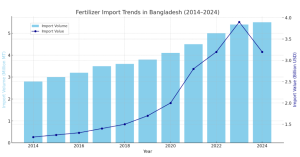

1. Import Volumes & Value

- 2022–23: ~5.41 million MT imported; cost ~US$3.89 billion in first 7 months

- 2023–24 (July–March): ~5.44 million MT, valued at Tk 275 billion (~US$3.2 billion)

- 2015: US$1.26 billion worth of fertilizer imports

- Dec 2024: Import value was BDT 28,968 million (~US$273 million)

- Jan 2022 peak: Import value peaked at BDT 60,679 million (~US$572 million)

2. Demand vs. Domestic Production

- Annual demand has surged to ~6–7 million MT

- 80% of the demand must be met through imports due to limited local

- Government factories (BCIC) supply ~1.1–1.2 million MT annually, covering ~15–20% of demanden.wikipedia.org+3scribd.com+3en.wikipedia.org+3.

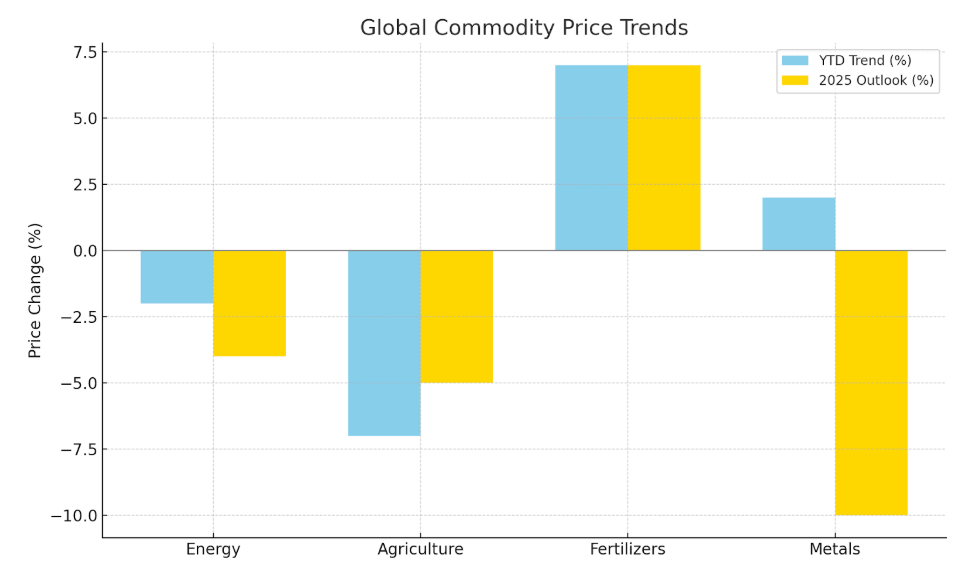

3. Price Volatility & International Market

- Global prices spiked in 2022 (Russia–Ukraine war), e.g., urea at US$821/MT in Q1 2022; dropped to ~US$351/MT by Q1 2024

- Bangladesh responded by importing from Russia, Saudi Arabia, Qatar, Morocco, and more in 2024 to offset production shortfall, fertilizerdaily.com.

4. Import Strategy & Government Response

- FY2023–24: Government approved import of 760,000 MT (150,000 MT in October 2024 alone)

- Sept 2024: BCIC procured 30,000 MT urea from Saudi at US$359/MT; BADC imported 110,000 MT

- March 2024: Cabinet approved 40,000 MT DAP from Saudi (US$576/MT), plus TSP, MOP, and urea from multiple suppliers

5. Monthly Value Trends

- Fertilizer import value ranges: BDT 10 million (June 2007) to BDT 60.7 billion (Jan 2022)

- Dec 2024 figure: ~BDT 29 billion, down from Nov 2024 (~BDT 20.3 billion); recent decline in early 2025 .

| Period | Volume (MT) | Value (US$ / BDT) | Key Trends & Drivers |

|---|---|---|---|

| 2014–2019 | ~15–17 lakh MT/year | ~US$1.26B (2015) | Gradual demand rise, local capacity gaps |

| 2020–2021 | ~16 lakh MT/year | Prices surged post-COVID | Pandemic-related disruptions |

| 2022–2023 | 5.4–5.5 million MT | ~US$3.8–3.9B (peak) | War-driven escalation, gas shortages |

| 2023–2024 | 5.4 million MT | ~Tk 275B (~US$3.2B) | Strategic imports during a price drop |

| 2024–2025 | ~5.4 million MT | ~BDT 29B/month | Stable pricing with consistent demand |

🔍 Key Insights

- Growing Demand: Annual demand has climbed to ~6–7 million MT—domestic production still limited.

- Import Dependency: ~80% reliance on imports makes Bangladesh sensitive to global price swings.

- Price Volatility: Cost peaked in early 2022; dropped in 2023–2024, relieving pressure.

- Active Government Involvement: Approved bulk purchases and diversified sources to stabilize supply.

- Strategic Sourcing: Multi-country procurement strategy enhances resilience.

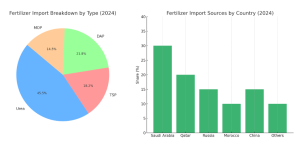

📦 By Fertilizer Type

- Urea: 2.5 million MT (~46%)

- DAP (Diammonium Phosphate): 1.2 million MT (~22%)

- TSP (Triple Super Phosphate): 1.0 million MT (~18%)

- MOP (Muriate of Potash): 0.8 million MT (~14%)

🌍 By Import Source Country

- Saudi Arabia: 30%

- Qatar: 20%

- Russia: 15%

- China: 15%

- Morocco: 10%

- Others: 10%

(includes UAE, Jordan, Tunisia, etc.)

✅ Recommendations

- Portfolio Diversification: Continue diversifying suppliers to buffer against global shocks.

- Advance Purchase Agreements: Use forward contracts to lock in lower prices.

- Local Production Investments: Encourage BCIC expansion to reduce import dependency.

Digital Forecasting: Use AI and ERP analytics to forecast demand and price trends more precisely.