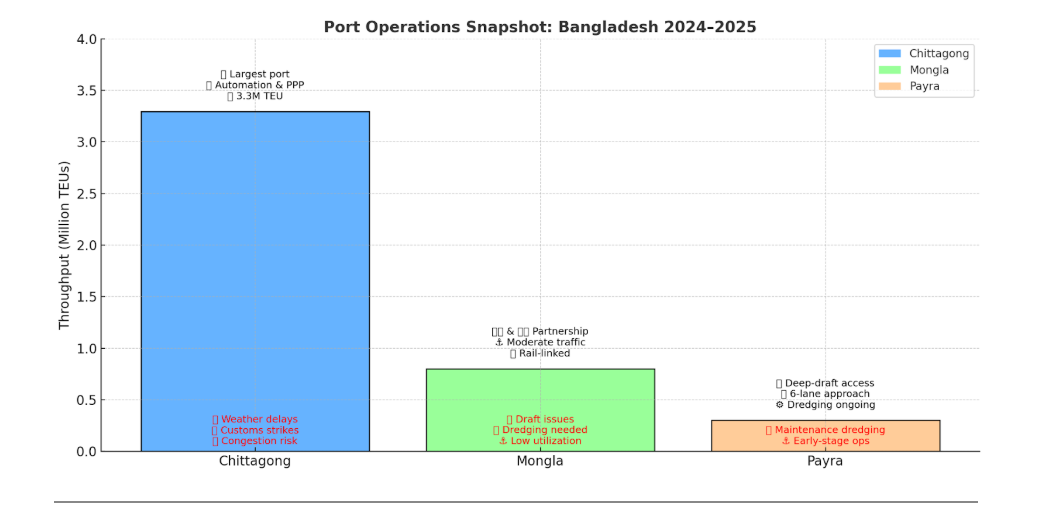

⚓ 1. Chittagong (Chattogram) Port

📈 Recent Performance

- Record container throughput (FY24–25): 3.296 million TEUs, up 4% from 3.169 million TEUs in FY23–24

- Revenue: Customs collected BDT 75,432 crore (+9.7%) .

- Monthly Volume: Feb 2025 saw 228,184 TEUs (+5.2% YoY) .

🏗️ Infrastructure & Efficiency Upgrades

- Bay Terminal project: $650M funding from the World Bank to build a climate‑resilient breakwater and access channel; expected to handle 36% of national container traffic and reduce ship turnaround times

- Automation drive: Implementing Container Terminal Management System, IoT-based tracking, and robotics to reduce dwell times from current 10–15 days

- Patenga Terminal privatization: 22‑year PPP with Red Sea Gateway Terminal (RSGTI) for increased capacity (~0.5M TEU)

🛠️ Operational Challenges

- Customs strikes: May–June 2025 NBR pen‑down action caused congestion; cleared after strike suspension and government intervention .

- Weather disruption: Heavy monsoon rains led to yard waterlogging, vessel queues (~13 vessels), and delays of 5–6 days

- Berth operator dispute: Container handling slowed at six jetties due to fee disputes .

2. Mongla Port

⚙️ Infrastructure & Capacity

- India granted operational rights (July 2024) to develop terminal capacity

- Current setup: 11 jetties, 8 warehouses, rail linkage to Khulna

- Channel depth/siltation: Draft varies from 4.5 m (low tide) to 8.5 m; dredging underway to improve capacity

🌐 Ongoing Developments

- Dredging projects: ENSuring improved access and reduced siltation

- PPP-backed Chinese agreement (March 2025) to modernize facilities and automate Mooring and cargo handling

3. Payra Port

🛳️ Expansion Status

- Capital dredging completed (Mar 2023) by Jan De Nul Group; currently supports vessels with 10.5 m draft

- Next phase: Maintenance dredging underway to preserve channel depth

🚧 Infrastructure Projects

- Port access: Six‑lane approach road and bridge constructed

- Strategic shift: From deep‑seaport ambitions to a regular seaport under PPP framework

🔎 Comparative Snapshot

| Port | Throughput (FY24–25) | Key Strengths | Challenges |

| Chittagong | 3.296 M TEUs | Largest in Bangladesh; massive PPP and automation investments | Customs strikes, monsoon delays |

| Mongla | Moderate, underutilized | Terminal modernization via India/China partnerships | Draft limitations, need dredging |

| Payra | Early-stage operations | Deep-draft channel, good access road infrastructure | Continual maintenance dredging needed |

✅ Trends & Outlook

- Moderate container throughput growth at Chattogram, with long-term efficiency gains from infrastructure investments.

- Ongoing automation and digitalization efforts mark a shift toward “smart port” capabilities.

- Strategic expansions: PPPs in Chittagong, international partners at Mongla, and phased development of Payra.

- Vulnerability to external disruptions: Weather impacts and labor disputes remain key operational challenges.

| Port | Throughput (Est. 2024–25) | Strengths | Challenges |

| Chittagong | 3.3 million TEU | 🚢 Largest national port 🔧 Automation & PPP expansion 📊 Strong volume handling | ⛈️ Weather delays ✊ Customs strikes 🚧 High congestion risk |

| Mongla | 0.8 million TEU | 🇮🇳 & 🇨🇳 Partnerships ⚓ Moderate traffic 🚆 Rail-linked potential | 🌀 Low draft depth 🛠️ Dredging required ⚓ Under-utilized |

| Payra | 0.3 million TEU | 🌊 Deep-draft (10.5m) 🛣️ 6-lane access roads ⚙️ Strategic future capacity | 🔄 Maintenance dredging ⚓ Early-stage infra |