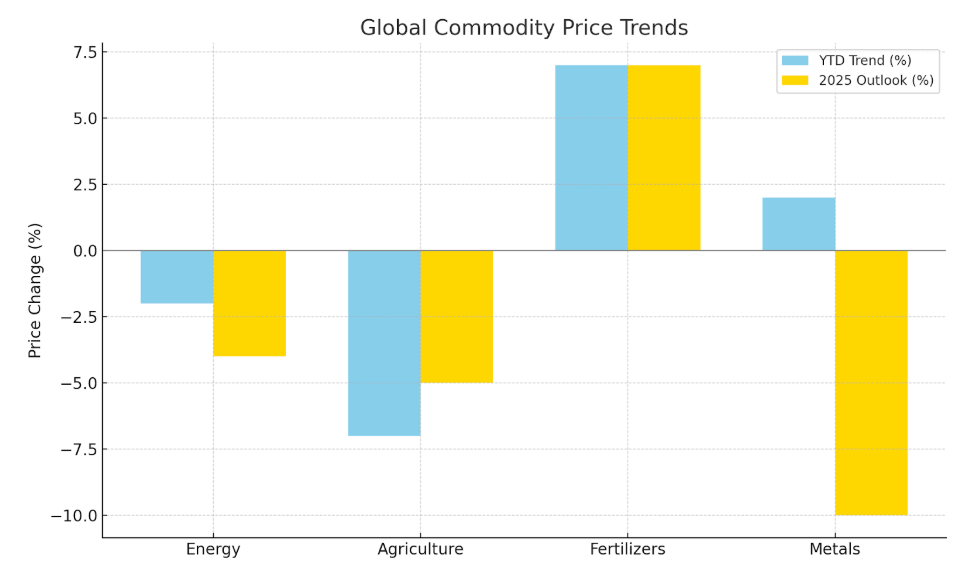

1. 📉 Overall Commodities

- The IMF global price index declined to 160.9 in May 2025, down about 1% from April and ~4.6% year-over-year

- The World Bank forecasts a broader commodity price drop: ~12% in 2025, followed by ~5% in 2026, driven by weak growth and oversupply

2. 🔥 Energy (Oil, Gas, Coal)

- Crude Oil:

- Brent currently around $67–70/barrel, supported by geopolitical flare-ups in the Middle East

- S&P projects WTI dipping to upper $40s in late 2025 post oversupply. OPEC+ raising output contributes to downward pressure

- Futures trading soared—record 219M lots in Q2 as traders hedge volatility

- Natural Gas & Coal:

- LNG demand in Europe surged 21.6%—Asia demand dropped ~6% due to price sensitivity

- Coal prices expected to fall ~27% in 2025, continuing oversupply trends

3. 🌾 Agriculture & Food

- FAO Food Price Index: 128 in June—up slightly month-over-month, yet ~20% below March 2022 peak

- Food commodities: Despite higher dairy, meat, and oils, cereal and sugar prices dropped; global food prices down ~2% in Q1, forecasted to fall further in 2025 .

- Grains & Oils:

- Wheat & maize stabilized after early-year volatility, with anticipated declines of ~2% in 2025 .

- Soybean meal/oil down ~5–7% Q1 YoY .

- Rice prices plunged ~14% in Q1, now ~29% below last year, due to abundant supply

4. 💊 Fertilizers

- The fertilizer index rose ~6–7% in Q1 2025, reflecting tight supply and increased nitrogen (urea) prices (+12–20% YoY)

- Global fertilizer prices projected to increase ~7% in 2025, stabilizing in 2026

5. 🏗️ Metals

- IMF and Reuters report increases in precious metals and base metals between Aug 2024 and Mar 2025

- Copper +8–12%, Aluminium +12.7% (tariffs-driven gains), Tin and precious metals also strong; nickel flat, zinc -6% due to surplus

- Outlook: World Bank forecasts a 10% drop in metal prices in 2025, with tin a probable outperformer; gold and silver expected to rise due to safe-haven demand .

🔍 Summary Table

| Category | Current Trends | Outlook (2025) |

| Energy | Brent ~$68–70; futures volatility high | ↓ Prices (~$64 avg); oversupply |

| Agriculture | Food index easing; cereals softening | ↓ ~7% food; grains/oils mild declines |

| Fertilizers | Up ~6–7% in Q1; urea tight | ↑ ~7%, stabilizing in 2026 |

| Metals | Copper/metals up; tin strong | ↓ ~10% metals; gold/silver ↑ |

| Overall | Commodity index down ~5% YTD | ↓ ~12% overall in 2025; ↓5% in 2026 |

✅ Strategic Implications

- Price Relief Expected: Softening in food, energy, and metals could ease inflation and input costs globally.

- Fertilizer Pressure: Continued price strength may impact agricultural margins and government subsidy pressures.

- Metal Sector Readiness: Surplus risks in industrial metals may affect mining sectors; gold/silver may attract safe-haven flows.

- Energy Uncertainty: Geopolitical shocks may spike prices even as structural oversupply persists.